Fuel Cells for AI Data Centers 2026: Why Grid Delays Make On-Site Power Viable Now

Fuel Cell Adoption for AI Data Centers: From Niche Backup to Primary Power Solution

The market has decisively shifted from viewing fuel cells as a niche backup power source to a primary enabler for AI data centers, driven by crippling grid interconnection delays that make speed-to-market the most critical economic factor. This transition is defined by a move from small-scale technical validation to multi-megawatt commercial deployments designed to bypass grid constraints entirely.

- Between 2021 and 2024, industry adoption was characterized by pilot projects aimed at technical validation for backup power. For example, Microsoft successfully tested a 3-megawatt hydrogen fuel cell system in 2022 to prove its feasibility for replacing diesel generators, establishing a baseline for reliability and performance.

- Starting in 2025, the strategy pivoted to using fuel cells for primary, on-site power to circumvent grid limitations. Bloom Energy’s collaboration with Oracle in July 2025 to deliver power within 90 days exemplifies this shift, directly contrasting with the multi-year queues for new grid connections.

- This change demonstrates that the primary value driver is no longer just emissions reduction but deployment speed. The opportunity cost of a delayed AI data center now exceeds the higher capital expenditure of a fuel cell installation, fundamentally altering the economic calculation for hyperscalers.

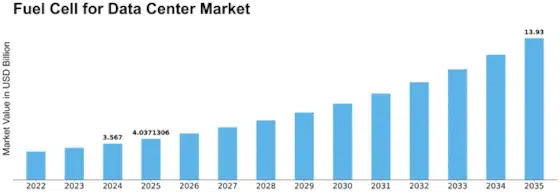

Fuel Cell Data Center Market to Soar

This chart projects significant growth in the data center fuel cell market, directly validating the section’s focus on the sector’s shift from a niche backup to a primary power solution.

(Source: EnkiAI)

Fuel Cell Investment Analysis: Billions Allocated to Bypass AI Power Constraints

Capital allocation has decisively shifted from funding component-level research and manufacturing scale-up to financing large, deployable fuel cell infrastructure specifically for AI, signaling strong investor confidence in the business case for grid-independent power. This is evidenced by the emergence of dedicated, multi-billion-dollar investment vehicles targeting AI power.

- Before 2025, investments were largely focused on technology development and manufacturing capacity, such as the $40 million in U.S. Department of Energy grants awarded to Ballard Power Systems in March 2024 to support its Texas Gigafactory.

- In October 2025, the investment model transformed with Brookfield Asset Management’s commitment of up to $5 billion in a strategic partnership with Bloom Energy. This created a dedicated financing platform for “AI power factories, ” moving fuel cells from a product sale to an infrastructure asset class.

- This trend was reinforced in January 2026 by American Electric Power’s $2.65 billion supply agreement with Bloom Energy for an unnamed data center customer. This large-scale utility procurement de-risks project backlogs and validates fuel cells as a bankable solution to the data center power crisis.

Table: Key Investments in Fuel Cell Infrastructure for AI

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| American Electric Power (AEP) | Jan 2026 | Supply agreement to acquire $2.65 billion of Bloom Energy’s solid oxide fuel cells, securing a large-scale power source for a data center customer and bypassing grid dependency. | Bloom Energy Fuel Cell Deals Put AI Data Center Power In Focus |

| Brookfield Asset Management | Oct 2025 | Strategic partnership to invest up to $5 billion to deploy Bloom Energy’s fuel cell technology. The goal is to create a financing vehicle for “AI power factories” and de-risk project development. | Brookfield and Bloom Energy Announce $5 Billion Strategic AI Infrastructure Partnership |

| ECL | Sep 2024 | Announced plans for a $8 billion, 1 GW off-grid, hydrogen-powered AI data center. The project represents a long-term vision for zero-carbon AI infrastructure, though it is in the early planning stages. | ECL Announces 1 GW Off-Grid AI Factory |

| U.S. Department of Energy (DOE) / Ballard Power Systems | Mar 2024 | Ballard received $40 million in DOE grants to support the build-out of its fuel cell Gigafactory in Texas, aimed at scaling manufacturing to reduce costs and meet growing demand. | Ballard announces $40 million in DOE grants |

Strategic Partnerships for Fuel Cell AI Infrastructure: From Tech Validation to Commercial Scale

Partnerships have evolved from bilateral technology validation between tech companies and fuel cell manufacturers to complex, multi-party alliances involving infrastructure investors and utilities, designed to finance, build, and operate on-site power at a commercial scale. This structural change reflects a maturing market where deployment and financing are as critical as the technology itself.

- In the 2021-2024 period, partnerships focused on technical proof-of-concept. This included Microsoft’s work with Caterpillar and Ballard to test hydrogen for backup power and IBM’s collaboration with Fuel Cell Energy to use AI for extending fuel cell lifespan.

- Since 2025, alliances have shifted to enabling commercial deployment and financing at scale. The Bloom Energy and Brookfield partnership created a dedicated vehicle for project financing, while the Fuel Cell Energy and SDCL letter of intent from January 2026 aims to deploy up to 450 MW by pairing technology with an established energy infrastructure operator.

- The collaboration between Bloom Energy and Oracle in July 2025 is significant for its explicit commercial goal: delivering on-site power to AI data centers within 90 days. This partnership directly weaponizes deployment speed as a competitive advantage against the grid.

Table: Key Partnerships Driving Fuel Cell Viability for AI

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 2026 | A letter of intent for a strategic collaboration to explore deploying up to 450 MW of fuel cell power systems for data centers. The partnership provides a financing and operating framework to scale deployments globally. | Sustainable Development Capital LLP and Fuel Cell Energy Forge Strategic Data Center Power Collaboration |

| Bloom Energy & AEP | Jan 2026 | A $2.65 billion supply agreement where utility AEP will acquire Bloom Energy’s fuel cells for a data center customer. This alliance signals utility-level acceptance of fuel cells as a grid-alternative solution. | How the AI data center bubble story is playing out inside the stock market |

| Bloom Energy & Brookfield | Oct 2025 | A strategic partnership to finance up to $5 billion in fuel cell deployments for AI data centers. This alliance provides the dedicated capital required to build out “AI power factories” at scale. | Brookfield and Bloom Energy Announce $5 Billion Strategic AI Infrastructure Partnership |

| Bloom Energy & Oracle | Jul 2025 | A collaboration to deliver on-site power to Oracle’s AI data centers within 90 days. This partnership is designed to bypass grid interconnection delays, making speed-to-market the core value proposition. | Oracle and Bloom Energy Collaborate to Deliver Power to Data Centers at the Speed of AI |

Geographic Growth of Fuel Cell Data Centers: North America Leads as Grid Constraints Mount

North America has become the undisputed epicenter for large-scale fuel cell data center projects, a direct result of its concentration of AI development, hyperscale operators, and severely congested power grids in key markets. While early-stage projects are emerging in Europe and Asia, the most significant commercial agreements are centered in the United States.

North America Dominates Fuel Cell Market

This chart’s breakdown of the fuel cell market by region, showing North America’s leadership, perfectly illustrates the section’s argument that the continent is the epicenter for new projects.

(Source: Market Research Future)

- Between 2021 and 2024, fuel cell activity for data centers was geographically dispersed and focused on pilots. This included Microsoft’s hydrogen pilot project in Dublin, Ireland, and manufacturing investments like Ballard’s Gigafactory in Texas, USA.

- From 2025 onwards, the largest commercial deals have been concentrated in the U.S. This includes the multi-billion dollar supply agreements involving Bloom Energy with partners like Brookfield and AEP, as well as the ambitious plan for a 1 GW hydrogen-powered data center in Texas by ECL.

- International expansion is now following this trend, with grid constraints emerging as a global problem for AI deployment. Fuel Cell Energy’s agreement to explore a 100 MW deployment in Daegu, South Korea, shows that Asian markets are also turning to on-site power to support their AI ambitions.

Fuel Cell Technology Maturity: SOFCs Reach Commercial Scale for Data Center Prime Power

Solid Oxide Fuel Cells (SOFCs) have matured from a theoretical backup power technology to a commercially viable prime power solution for data centers, validated by multi-gigawatt supply agreements and their ability to run efficiently on readily available natural gas. The key metric for maturity has shifted from technical efficiency in a lab to proven deployment speed and scalability in the field.

SOFCs Drive Fuel Cell Market Growth

This forecast shows Solid Oxide Fuel Cells (SOFCs) as a significant and growing segment of the market, underscoring the technology’s maturity and commercial viability as discussed in the section.

(Source: Polaris Market Research)

- During the 2021-2024 period, the primary focus was on demonstrating the technical readiness and reliability of different fuel cell types. Microsoft’s successful 2022 test of a 3-megawatt PEM fuel cell system validated its use for backup power, while SOFCs were proven in smaller-scale, high-efficiency stationary applications.

- Beginning in 2025, the commercial viability of SOFCs for prime power was confirmed through massive supply deals. The technology from Bloom Energy is at the center of the $5 billion Brookfield partnership and the $2.65 billion AEP agreement, proving it is bankable at scale.

- While a future powered by green hydrogen fuel cells remains the long-term goal, as seen in ECL’s proposed 1 GW project, the current market is dominated by “hydrogen-ready” SOFCs running on natural gas. This pragmatic approach provides a critical bridge, allowing data centers to be built today while offering a path to future decarbonization.

SWOT Analysis: Assessing the Viability of Fuel Cells for AI Infrastructure

The primary strength of fuel cells is their ability to provide rapid, grid-independent power, a value proposition that has intensified since 2025 due to worsening grid delays. However, their viability remains constrained by high upfront capital costs and a near-term dependence on volatile natural gas prices, creating a clear trade-off between speed and cost.

Texas Grid Overload Highlights Power Deficit

This chart visualizes extreme grid congestion, providing powerful context for the SWOT analysis by illustrating the ‘Opportunity’ that worsening grid delays create for grid-independent power.

(Source: SemiAnalysis)

- Strengths have shifted from technical attributes like high efficiency to commercial advantages like rapid deployment, which directly addresses the AI industry’s most critical bottleneck.

- Weaknesses, primarily high CAPEX, persist but are now weighed against the enormous opportunity cost of multi-year project delays, making the premium for speed more justifiable for hyperscalers.

- Opportunities have exploded from a general trend of decarbonization to the acute, multi-trillion-dollar AI infrastructure buildout, which cannot proceed without power certainty.

- Threats remain centered on fuel costs, with near-term exposure to natural gas price volatility and long-term uncertainty around the cost and availability of green hydrogen.

Table: SWOT Analysis for Fuel Cell Viability in AI Infrastructure

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (50-60%); low on-site emissions compared to diesel generators; high reliability due to few moving parts. | Rapid deployment (6-12 months vs. 3-5+ years for grid); grid independence; high power density (33 MW/acre). | The core strength shifted from being a ‘better generator’ to a ‘grid-avoidance’ strategy. Oracle’s 90-day deployment goal with Bloom Energy validated this. |

| Weaknesses | High capital cost ($3, 000-$4, 000/k W); dependence on hydrogen infrastructure which was largely non-existent; limited commercial-scale deployments. | High CAPEX remains, though now offset by opportunity cost; near-term reliance on natural gas exposes projects to price volatility. | The weakness is no longer a deal-breaker. The $5 billion Brookfield fund and $2.65 billion AEP deal demonstrate that the high CAPEX is considered a bankable and necessary investment. |

| Opportunities | Growing corporate ESG goals; government R&D funding (e.g., DOE grants); replacing aging backup diesel generator fleets. | Explosive AI power demand crisis; multi-year grid interconnection queues; extreme electricity price volatility (spikes to $1, 000/MWh). | The opportunity grew from a niche sustainability play to solving the primary constraint on a trillion-dollar industry. Goldman Sachs estimates fuel cells could meet 6-15% of new data center power demand. |

| Threats | High cost of green hydrogen (>$30/kg); slow development of hydrogen supply chains; competition from grid-scale renewables and storage. | Natural gas price fluctuations directly impacting OPEX; competition from on-site natural gas turbines; potential for grid modernization to eventually reduce queue times. | The immediate threat shifted from the long-term challenge of hydrogen cost to the short-term reality of natural gas market exposure. |

2026 Forward Outlook: Fuel Cell Growth Hinges on Execution of Megawatt-Scale Contracts

The continued acceleration of fuel cell adoption for AI data centers depends directly on the successful execution of the massive supply agreements and financing partnerships announced in 2025 and early 2026. These projects serve as the ultimate validation of the technology’s business case, and their progress will determine whether fuel cells become a mainstream solution or remain a niche alternative.

Data Center Power Demand to Surge

This forecast of surging data center power demand provides critical context for the forward outlook, illustrating the massive energy need that new fuel cell projects are aiming to meet.

(Source: EnkiAI)

- If the initial “AI power factories” funded by the $5 billion Brookfield-Bloom Energy partnership are deployed on schedule and meet their projected performance and cost targets, then this will validate the model for treating on-site power as a financeable infrastructure asset, attracting significantly more institutional capital to the sector.

- Watch for announcements confirming the specific customers and locations for the $2.65 billion AEP supply deal and tangible progress on deploying the first tranches of the 450 MW pipeline from the Fuel Cell Energy-SDCL collaboration. These are the most immediate signals of market execution.

- This could mean that the data center power market further bifurcates, with hyperscalers in grid-constrained regions like Northern Virginia or Silicon Valley adopting on-site fuel cells as a standard deployment strategy. A slowdown or failure to execute on these large contracts would signal a retreat to traditional power sources and a potential stall in the market’s growth trajectory.

Frequently Asked Questions

Why are fuel cells suddenly a viable power source for AI data centers?

The primary driver is crippling grid interconnection delays, which can last for years. Fuel cells can be deployed on-site in as little as 90 days, making speed-to-market the most critical economic factor. The article argues that the opportunity cost of a delayed AI data center now exceeds the higher capital cost of a fuel cell installation.

How has the use of fuel cells for data centers changed since 2025?

Before 2025, fuel cells were primarily used in pilot projects for backup power, aiming to replace diesel generators. Since 2025, the strategy has shifted to using them for primary, on-site power in multi-megawatt commercial deployments designed to bypass the grid entirely, as seen in collaborations between Bloom Energy and partners like Oracle and AEP.

Are these fuel cells environmentally friendly if they run on natural gas?

While the long-term goal is to use green hydrogen, the current market is dominated by Solid Oxide Fuel Cells (SOFCs) that run on natural gas. The article describes this as a pragmatic “critical bridge,” allowing data centers to be built immediately with a power source that has lower on-site emissions than diesel. These systems are often “hydrogen-ready,” offering a future path to decarbonization.

Isn’t it more expensive to use fuel cells than traditional grid power?

Yes, fuel cells have a high upfront capital cost (CAPEX). However, the economic calculation has fundamentally changed. The massive opportunity cost of a multi-year delay while waiting for a grid connection is now considered greater than the premium paid for a rapid fuel cell deployment. Multi-billion dollar investments from firms like Brookfield Asset Management validate that this higher cost is now seen as a bankable and necessary expense for speed.

Who are the key companies and partners driving this trend?

The trend is driven by alliances between fuel cell manufacturers (like Bloom Energy and Fuel Cell Energy), tech giants who need the power (like Oracle and Microsoft), and large financial partners and utilities (like Brookfield Asset Management and American Electric Power). These multi-party partnerships are designed to finance, build, and operate on-site power at a commercial scale.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.